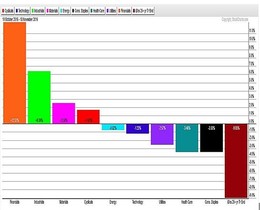

November 20, 2016: Market Minute: The swift shift from safety to riskPart of the U.S. president-elect's narrative has been on invigorating the economy. Massive spending on upgrades in schools, highways, hospitals and infrastructure have all been mentioned. The market, in response to the proposed spending, quickly shifted from safety assets to risk and growth. Four sectors, in particular, saw solid selling pressure over the last 30 days (Chart 1). Utilities, Healthcare, Consumer staples saw an average decline of 3.60 percent. 20-year Treasury bonds lost the most of the safe-haven assets with a sharp 9.05 percent drop. The Financials and Industrial sectors received the most lift from the president-elect rising almost 10 percent since early November. Gains were not just limited to stocks. The US dollar soared over 4.50 percent and copper, broke out of a multi-month base to rocketed up 23 percent before settling back to $2.45. Stock indexes too shared in the massive spending optimism. After four months of flat consolidation, the Dow jumped 3.5 percent since early November. The S&P 500 moved up 2.70 percent and the small-cap Russell 2000 advanced by over 12 percent (Chart 2). Bottom line: The election of Donald Trump and his narrative of massive infrastructure spending has invigorated the markets and sent some sectors soaring. Financial and industrial sectors are the big winners posting an average of almost 10 percent since early November. On the losing side are the safe-havens. Utilities, healthcare and consumer staples saw heavy selling over the last two weeks dropping down by about 3.60 percent. The safe-haven of bonds also saw some of the strongest selling. The 20-year US Treasuries lost over 9 percent over the last month. We anticipate this strong split in sector performance to continue into Q1, along with strength in the US dollar, copper and the markets in general.

Donald W. Dony, FCSI, MFTA |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|