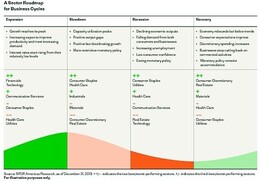

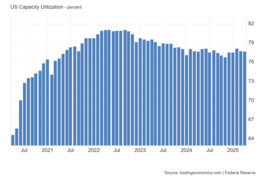

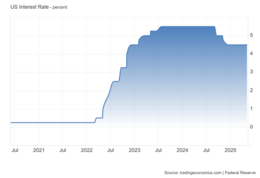

June 09, 2025: Recognizing the Slowdown Phase of the Business CycleFollowing the May 13, 2025 update, 'Business Cycle Shifts to the Slowdown Stage,' economic data continues to build on the outlook of a cooling economy (Chart 1). The four stages of a business cycle are expansion and growth, the slowdown stage, where economic development peaks and stalls, the recession phase, and recovery. These phases are closely linked to the movements of the stock market. The four stages of the market cycle are the accumulation phase (bull market), the markup phase (final upward movement), the distribution phase (market crest), and the downturn phase (bear market). The first two phases and the last two stages are considered mirror images. Accumulation is when businesses and investors increase their market exposure. This is the expansion phase of the business cycle. In the distribution phase (slowdown stage), investors start reducing their market exposure due to weakening economic data. Some of the road signs are softening capacity utilization (Chart 2). Utilization peaked in Q2, 2021 at 12.2%. Over the next four quarters, the average growth was 4.3%. Since early 2022, growth has stayed between 3.20% and 2.10%. Monetary policy also helps define the stage of the business cycle. Starting in mid-2022, the Fed began a period of restrictive monetary policies. Interest rates advanced from 0.5% to 5.5% in 2024 (Chart 3). Bottom line: An increasing number of road signs point to the economy and stock market entering a slowdown phase. Some of the typical economic signals are capacity utilization peaking, positive output but with decelerating growth, and a more restrictive Fed monetary policy. |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|