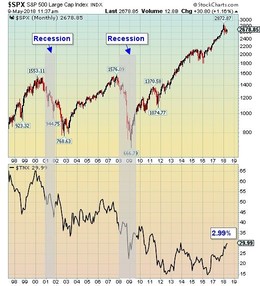

May 09, 2018: Market Minute: The S&P 500 and Treasury Yields: A 20-year perspectiveThis is a chart comparison between the S&P 500 and the 10-year yields. It shows the rise in bond yields is a normal action during a bull market. In the last phase of the 1980 to 2000 secular equity rise and throughout the 2003 to 2007 bull market, 10-year U.S. Treasury yields advanced. And in the course of the last two recessions, rates dropped sharply to try and invigorate a slumping economy and stock market. During the last six years, rates were kept contained between 1.50% and 2.95%. Bond yields are starting to rise again in 2018 as the U.S. economy posted its 7th quarter of continuous GDP expansion. We can see how the Fed has used the rate to accelerate the economy and growth, and when needed, apply the brakes. Moving forward, the Fed has mentioned 3 to 4 rate hikes can be expected in the coming 12 months. This rise in bond rates would be on par with past actions during periods of economic expansion and stock market growth. Bottom line: Following the past movements from the Fed, the 10-year Treasury yields are expected to rise in 2018. Models project a late 2018 target of 3.70%. |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|