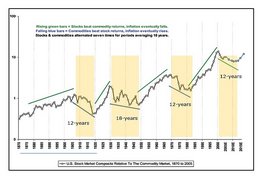

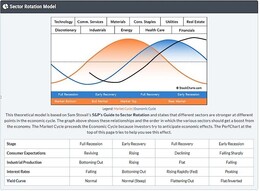

December 15, 2021: A simple way to outperform the index (S&P 500)This short report is about a simple straight forward method of outperforming the S&P 500. Just buying the index (SPY) outperforms about 95% of fund managers, mutual funds and private broker client accounts over any five year period. But this article is about outperforming. Let's look at how that can be achieved. The first step is identifying the position where the market is in this secular bull market. Chart 1 is a relative strength comparison between the Dow Jones Industrial Average and the CRB Commodity Research Bureau Index. It dates back 134 years. Starting in 1905, a series of cycles developed. Each cycle lasted, on average, about 18 years. The current bull market, though officially started in 2009, the Dow began to lead over the CRB in 2012 and has progressed for about 11 years. That would suggest that the bull market should have another 4-6 more years. Chart 2 illustrates the normal sector rotation progression during the economic, interest rate and stock market cycles. At the current junction, the Fed is indicating that interest rates will likely start to increase in 2022. So rates are at the bottom of their curve. US Consumer expectations and US Industrial production have both increased in 2020 and early 2021. The US Yield Curve is in a normal position and steep. Base metals (the largest portion of the materials sector) is outperforming the S&P 500. These elements (Dow/CRB cycle, economic factors and base metal performance, suggests that the stock market cycle is still in, what is referred to, as an "Early Recovery" stage. The final step (Chart 3) to having a portfolio that outperforms the S&P 500 (SPY) is: (1) half the portfolio always holds the S&P 500, and (2) the other half holds those ETF sectors that are outperforming SPY. In Chart 3, the time frame is 180 days. There are six (6) sectors that are outperforming and five (5) sectors that are underperforming SPY. Those six ETFs will make-up the other 50% of the portfolio. Every 180 days another review of which ETFs are outperforming and which are underperforming. Those new ETFs that are outperforming are bought and those new ETFs that underperforming are sold. Bottom line: By holding half of the portfolio always in the benchmark S&P 500 and routinely reviewing which ETF sectors are outperforming, a portfolio should hold a lead in performance over the S&P 500 year after year. |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|

.jpg)