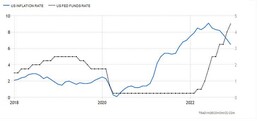

January 14, 2023: More signs of a mature marketThis report is our fifth article since September about the maturing bull market and the multiple road signs that are developing. One of the signs of a maturing economy is the rise in inflation. As the economy continues to expand, there is ongoing pressure for goods and services. Employment is usually at a record high and consumer spending continues to rise (as they both are now). This stress on goods, if prolonged, can create inflationary pressure (chart 1). With inflation, comes a rise in interest rates. This action is generally the first line of defense to curb inflation. If inflationary pressure is persistent then multiple interest rate hikes are administered. This action will eventually create what is called an inverted yield curve (chart 2). Currently, there are 28 world economies that have an inverted yield curve. This is the highest number of inverted curves since the bull market started in 2009. A prolonged inverted yield curve (most world economies have had inverted curves since mid-2022) holds the record of predicting the last 7 recessions. The final piece of evidence of a mature market is the sectors that show the most performance (chart 3). Over the last 60 days, most of the late market sectors are illustrating the highest performance. Materials (base and precious metals) are leading in return. Consumer staples, financials, real estate, healthcare, and utilities are all leading the performance of the S&P 500. Bottom line: The bull market and economic expansion has been progressing for 14 years. The signs of advanced age are showing. Our models point to a pullback in Q1 and Q2 in equity markets. |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|

.jpg)

.jpg)