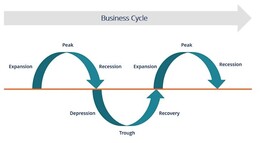

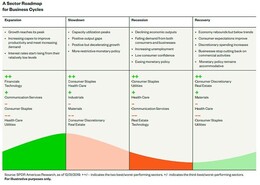

August 09, 2023: Business Cycle basicsThe Business Cycle provides unique information to the investor that can not be obtained through any other methodology. It can offer evidence of what stage (recovery, expansion, peak, slowdown, recession) the economy and the stock market are in. Also by identifying the stage or phase of the business cycle, sector selection can be greatly narrowed. Certain industry groups outperform and others underperform during specific stages of the business cycle. What is the Business Cycle? The business cycles are the phases of expansion and contraction in economic activity. That economic activity is represented by not only GDP, but also the measures of industrial production, employment, income, and sales, which are the key economic indicators used for the determination of U.S. business cycle peak and trough dates (Chart 1). For most investors, being in the market during the expansion stage is the most profitable. But how do know what phase is the market in now? We know the stock market has been advancing for about 14 years. The average duration of a bull market since the 1930s has been about 18 years. This would suggest that the current stock market is mature. Business cycles are often much shorter than stock market cycles averaging about seven years but can range from 2 to 10 years (source: Wikipedia). Economic elements that correspond to the expansion stage are GDP growth reaching its peak (This action appears to have happened in June 2021 for the US and Canada) (Chart 2). Increasing capex (capital expenditure) to improve productivity and meet increasing demand (this action is still ongoing). Interest rates start rising from relatively low levels (rates began to rise in early 2022 in the US and in Canada). There are elements that cross over to the slowdown phase of the business cycle. Capacity utilization peaked in 2021, there is positive but decelerating GDP growth and there is a more restrictive monetary policy. The sectors that typically outperform during the expansion phase are Financials, Technology and Communication Services and industry groups that normally underperform during this stage are the safe havens. Consumer Staples, Health Care, and Utilities. A 60-day sector performance chart shows four industry groups outperforming the S&P 500. They are Technology, Communication Services, Consumer Discretionary and Industrials. The lowest-performing sectors are Consumer Staples, Health Care, and Utilities all sectors considered safe havens. This mix closely matches the model for the expansion phase in Chart 2 (Chart 3). Sector performance that matches the Slowdown stage of the business cycle has not started, yet. Bottom line: After 14 years of the bull market and economic expansion, most of the road signs in the Business Cycle still point to the expansion phase. However, there are a few emerging signals from the slowdown phase that imply that this part of the Business Cycle is near. |

|

|

|

|

D.W. Dony and Associates

4973 Old West Saanich Rd.

Victoria, BC

V9E 2B2

|

.jpg)